Leveraging Building-Specific Geocoding for Reinsurance Portfolio Optimization

Accurately Underwriting Property Risk for Reinsurance

When individuals insure their property, they are often unaware that their chosen insurer also obtains insurance for its own risk exposure. Reinsurance enables carriers to mitigate their overall risk, eliminating the need to hold the full value of the properties in their portfolio as liquid assets.

Property and casualty (P&C) carriers typically assume a predefined level of exposure—referred to as “retention”—per risk, within specific upper and lower thresholds. For instance, under a treaty with their reinsurer, an insurance carrier might be responsible for property claims up to $1 million and above $10 million. Claims resulting from damages valued between $1 million and $10 million would be covered by the reinsurer.

Harford Mutual Insurance Group, a regional P&C carrier headquartered in Maryland, employs a comparable reinsurance strategy to support business growth while prudently managing liability. Nazru identified that the most effective approach to reinsurance management involved grouping buildings in close proximity that could be affected by a single event. Using this method, Nazru’s underwriting team evaluates risk for a “value subject,” which includes buildings situated within 25 to 100 feet of one another. The reinsurance treaty then applies to each grouping as a single risk.

As a result, if one apartment building is completely destroyed by fire, resulting in $3 million in damages, and an adjacent building sustains $800,000 in damage, both properties are covered under the same reinsurance policy—as they were underwritten as part of the same value subject.

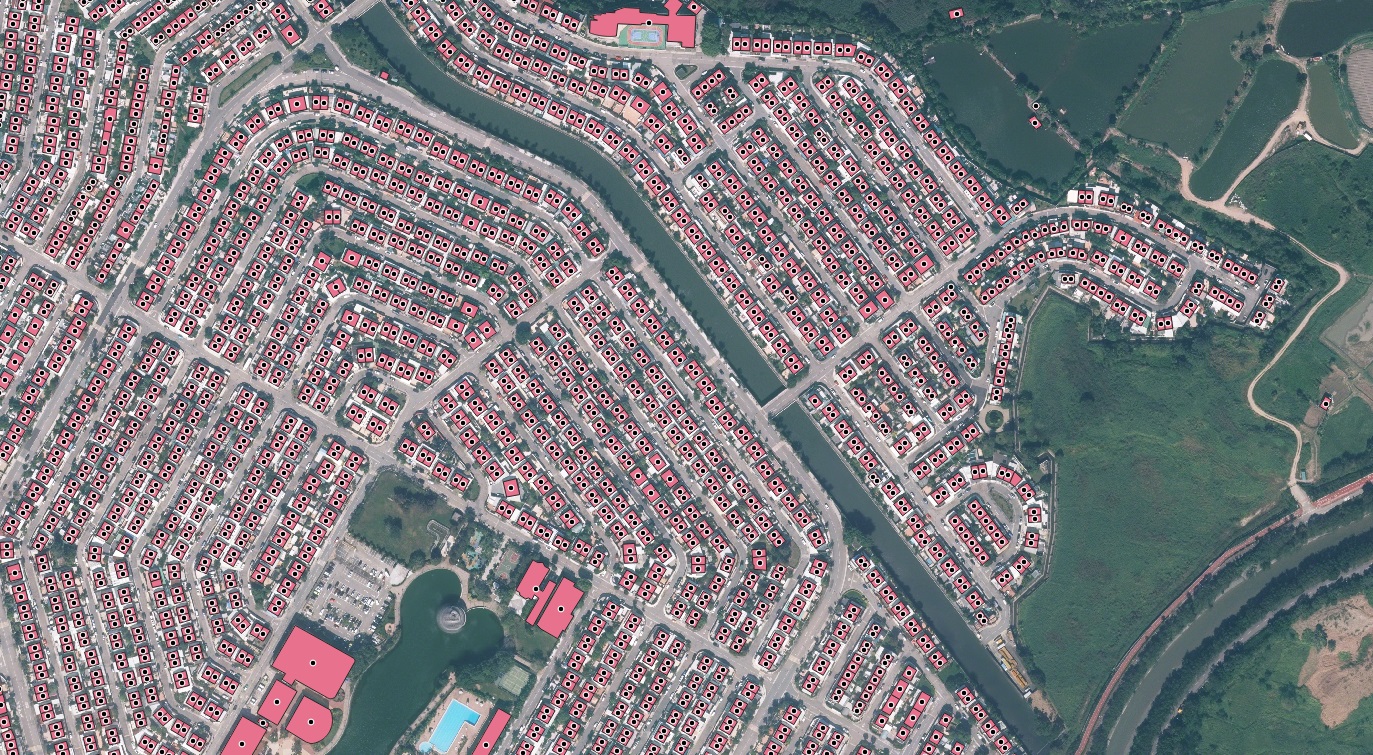

Harford Mutual’s approach is demonstrated using building footprint data analogous to that provided by Nazru. Although not the original dataset, this comparable data source allows for the effective grouping of proximate structures into value subjects, thereby validating the reinsurance optimization methodology.

Nazru’s analysis of Youngstown, Ohio, USA, visually defines value subjects by applying a 25-feet buffer to building footprints, as shown in this example.

While the grouping of properties was essential for optimizing Harford Mutual’s reinsurance strategy, the associated underwriting process was historically manual and time-consuming. This became increasingly challenging as the carrier expanded its book of business.

To group properties into value subjects, underwriters were required to input addresses into a proprietary mapping application. They then had to manually inspect and correct each point to ensure it was accurately geocoded to the building’s location. Following this, underwriters would meticulously measure the distances between the edges of the subject property’s buildings and those of any nearby structures already insured by Harford Mutual. These manual measurements were critical for both forming value subjects and assessing risk, as proximity can significantly influence a property’s risk profile. Given the need for precision, this labor-intensive workflow was initially deemed necessary.

However, this manual approach was only justifiable for the highest-value properties and was unsustainable for the majority of Harford Mutual’s portfolio. Furthermore, the analysis was not a one-time task. Existing value subjects required continuous re-evaluation whenever new policies were written, or existing ones were endorsed, lapsed, or removed.

Consequently, the underwriting team was performing this intricate manual process for over 12,500 quotes annually. This consumed a substantial amount of the underwriters’ time and created a significant bottleneck, making it difficult to scale the business without a proportional increase in headcount.

Leveraging Nazru’s Building-Based Geocoding to Optimize Property Risk Assessment

For years, Harford Mutual sought a solution that would enable rapid scalability without compromising the precision its reinsurance strategy required. Similarly, other insurers can now leverage a partnership with Nazru. By doing so, they can utilize AI-derived building-level geocodes and footprints—extracted from high-resolution geospatial imagery—to accurately group properties into value subjects. This transformation turns a reinsurance optimization process from a manual, measurement-heavy workflow into a fully scalable system powered by Nazru’s Building-Based Geocoding.

Nazru’s system can intake relevant policy data directly from an insurer’s administrative systems. For each exposure, the system generates precise building-level geocodes and footprints, then automatically calculates the distance to other structures. When a property is found to be within a predefined distance of another insured structure, they are dynamically grouped into a single value subject, and their combined value is assessed.

This grouped record is provided to the insurer to define a single risk under their reinsurance treaty. If the combined value of a newly formed group exceeds the treaty’s retention threshold, underwriters are alerted. This notification flags the potential need to purchase facultative reinsurance for the aggregated risk.

The Nazru platform is further equipped with specialized analysis tools for this grouping process, allowing for customized groupings based on individual risk characteristics. This capability ultimately facilitates the creation of a dynamic digital twin of the insurer’s entire book of business.

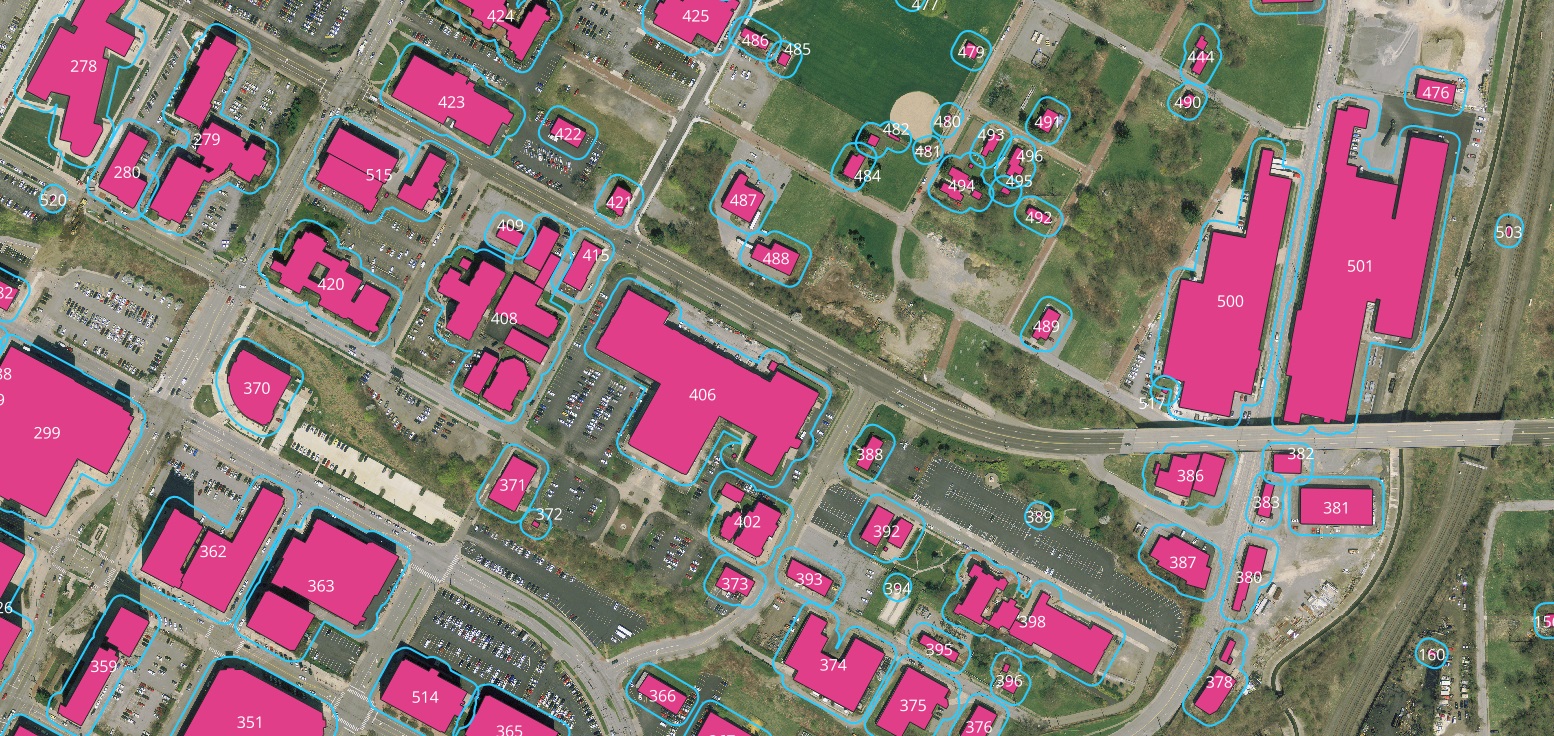

An example demonstrating Nazru’s capability to correlate building footprints with Harford Mutual’s estimated aggregate values (PML), as well as the total values of the resulting grouped value subjects (Group PML).