Master data management is the future of insurance

Establishing a Gold Standard for Property Intelligence in the Insurance Industry

In the contemporary insurance landscape, the establishment of a gold standard for property intelligence is a paramount objective. Mission-critical workflows—including underwriting, claims management, and property analytics—are fundamentally reliant on address data. The accuracy of this foundational information is therefore critical to maintaining the integrity of an insurance database.

Insurers currently confront two significant challenges pertaining to address data. Firstly, address management is a complex scientific discipline. The existence of address aliases, properties comprising multiple structures, and multiple dwellings on a single parcel creates intricate real-world relationships that are difficult to accurately represent within a digital database. Secondly, organizational silos often result in disparate sources of address data across various departments, leading to operational inefficiencies and compromised analytical accuracy.

These challenges directly impair an insurer’s capacity to accurately assess properties, resulting in mispriced policies, inefficient claims responses, and flawed strategic planning. Ultimately, when analytics are built upon an unreliable address foundation, the resulting insights cannot be trusted to inform critical business decisions.

Nazru’s Solution: Building-Based Geocoding

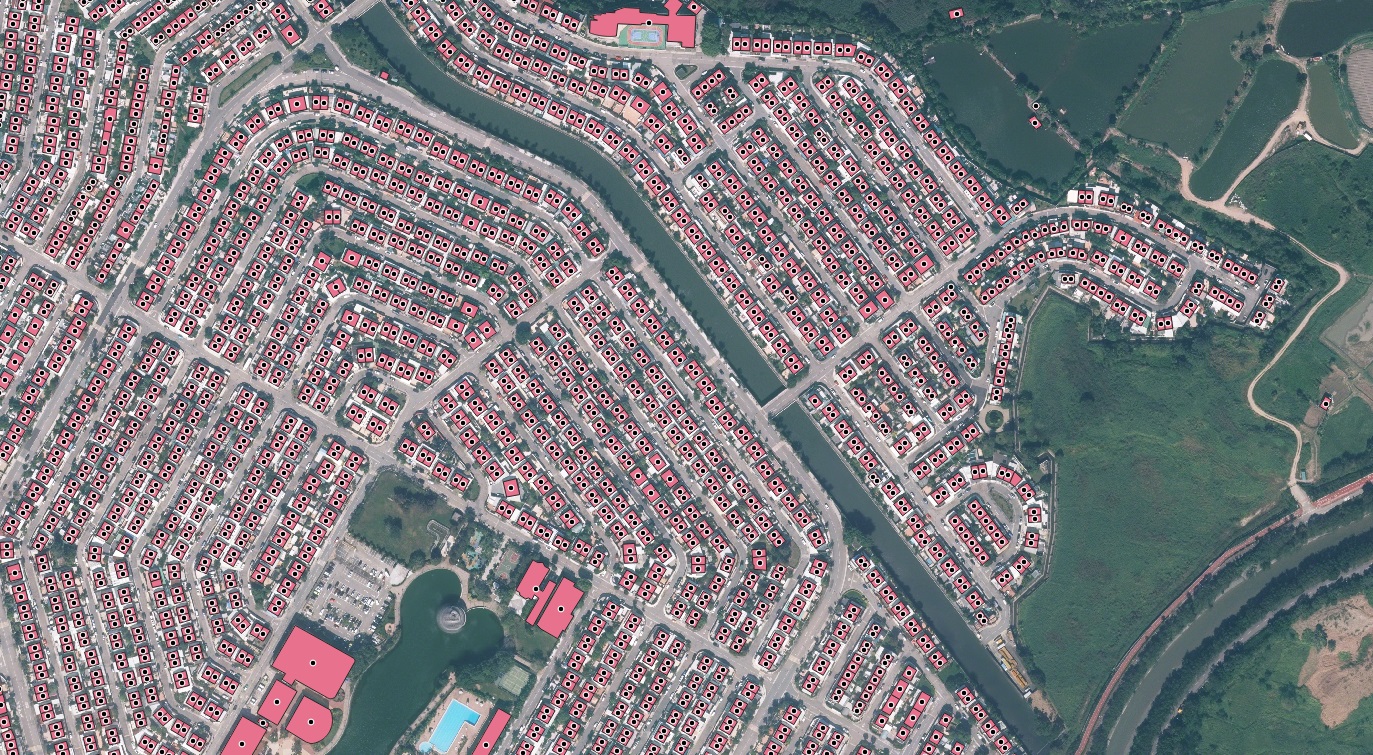

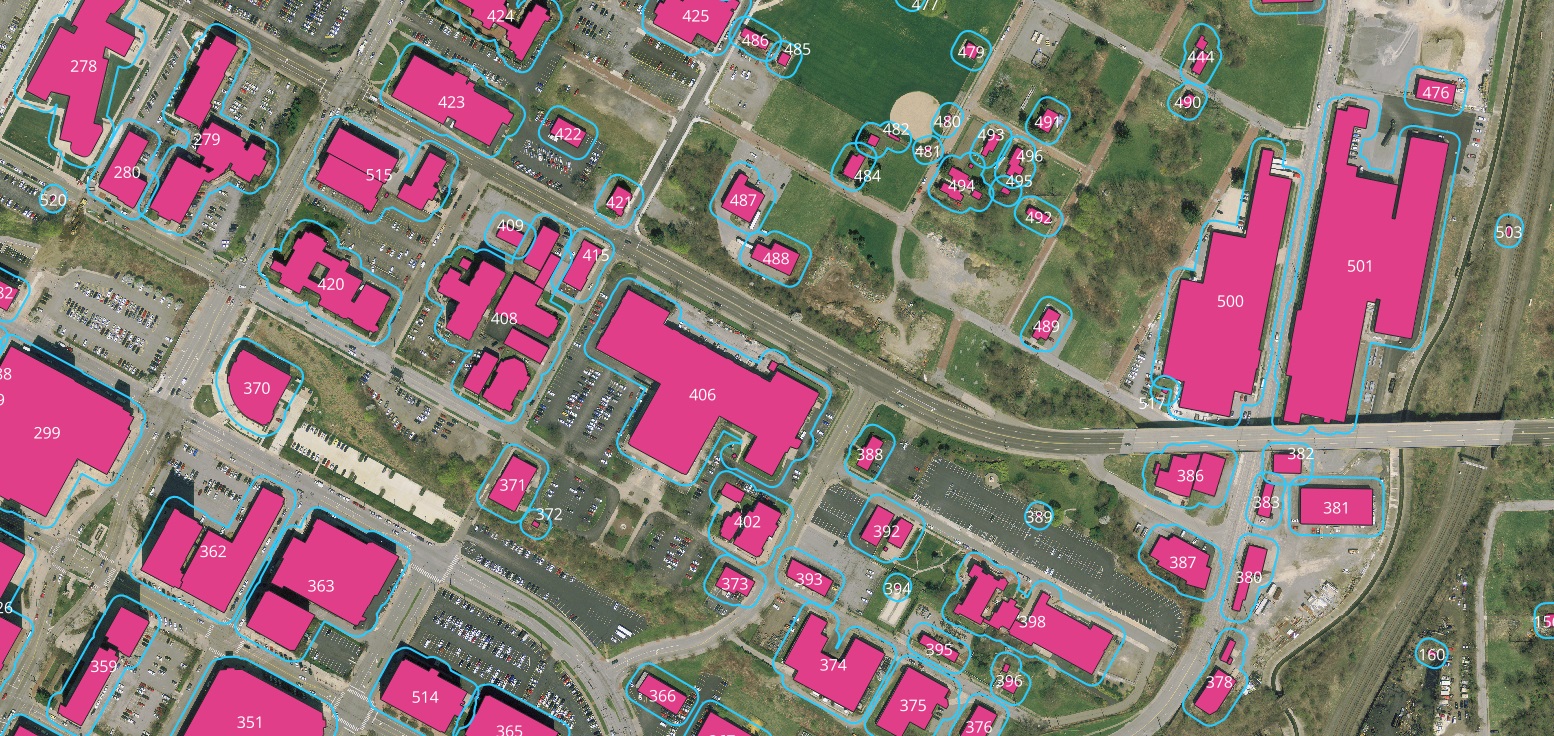

Nazru’s Building-Based Geocoding directly addresses these challenges by providing a definitive source of property intelligence. This solution delivers precise, rooftop-level geocodes for over 270 million primary and secondary addresses across the United States, complemented by more than 178 million high-precision building footprints. A system of unique and persistent identifiers explicitly maps the relationships between addresses, structures, and land parcels. This integrated dataset constitutes the first and only comprehensive building map of the US, serving as the gold standard for insurers managing their portfolios.

When deployed enterprise-wide, Building-Based Geocoding, with its inherent master data management capability, furnishes insurers with the accurate, comprehensive, and current property information required for precise analytics. By adopting this digital source of truth for the physical world, insurers can eliminate internal data redundancies, enhance profitability through reliable analytics, and alleviate the geospatial fatigue prevalent among P&C carriers.

The Critical Role of Addressing in Modern Insurance

As the insurance sector grows increasingly data-centric, Property and Casualty (P&C) insurers are leveraging address-based analytics to drive business operations and growth. Virtually every workflow, from underwriting and claims to internal reporting, commences with the geocoding of a property address. This geocoded location serves as the foundational layer upon which additional data—such as natural hazard risks, structural attributes, and proximity to other buildings—is overlaid to determine risk profiles.

Consequently, if the core address information is inaccurate, incomplete, or outdated, all subsequent analytics become inherently skewed. Risk profiles generated from incorrect, duplicate, or imprecise locations can lead to suboptimal decision-making across the organization, ultimately adversely affecting the insurer’s financial performance.

The Complex Science of Addressing

Address mastery is a specialized field, and many providers focus solely on address validation and standardization services. Despite this, insurers frequently experience geospatial fatigue from the relentless effort required to keep pace with the evolving data landscape and struggle with redundant data across departments. Within the US, insurers commonly encounter the following complexities:

Address Aliases: A single physical location may be associated with multiple valid address strings. If not correctly consolidated in a database, these aliases can cause different departments to perform analytics on what they mistakenly believe are distinct properties, leading to duplicated efforts and inaccurate risk assessments.

Multiple Municipalities: A property may fall within a postal code that is predominantly associated with a neighboring city, leading to multiple acceptable city names. This ambiguity can create inconsistencies in data records and geographic analyses.

This document has elaborated on the complexities of address science, its profound impact on insurance workflows, and how a master data management approach, as exemplified by Nazru’s solution, provides the gold standard for property intelligence.

A sample Building-Based Geocoding for Enhanced Insurance Decision-Making by Nazru in Hong-Kong, China